Image courtesy: Rebel Politik

Image courtesy: Rebel Politik

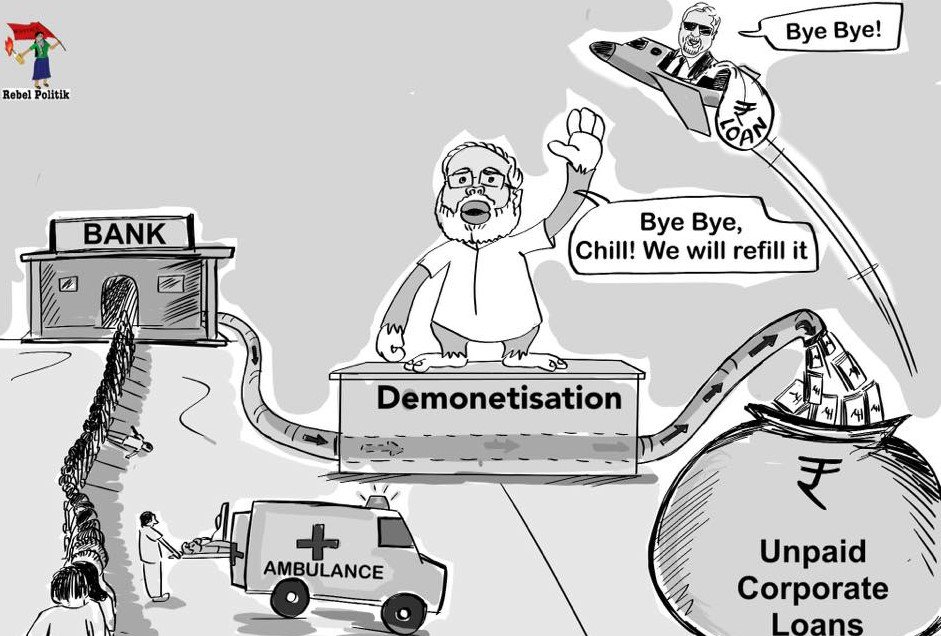

In the past few days, a few reports about the shocking scale of loot of public money by corporate bodies have come to light. Take a look:

-

In the past five years (2014 to 2018), banks have written off bad loans (NPAs) worth a mind-boggling Rs.5.56 lakh crore, as per an Indian Express report. ‘Write off’ means that the unreturned loans are put in the category of uncollectible debt.

-

Forensic audit of over 200 companies which had folded up and were facing insolvency proceedings has shown that there were irregularities worth Rs.1 lakh crore, according to an Economic Times report. This included diversion of funds, defrauding banks, circular transactions, etc.

Add to this the government’s revelation in Parliament earlier this year on bank frauds, wilful defaulters and economic fugitives:

-

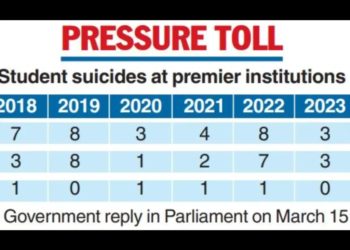

Bank frauds involving Rs.1 lakh and above have increased from 4,693 in 2015-16 to 5,076 in 2016-17 and further, to 5,917 in 2017-18, the Rajya Sabha was told in February this year (Question No.973).

And also:

-

In a reply in January this year in the Rajya Sabha (Question No. 2125), the government stated that there were 41 economic offenders who had defrauded banks and run away to foreign countries, 12 of which had a cumulative outstanding amount of Rs. 1,97,769 crore as on March 31, 2017 and the remaining 29 had outstanding amount of Rs. 1,35,846 crore as on June 30, 2017. That’s a total of about Rs.3.34 lakh crore.

-

In February, another reply (Question.No.969) in Rajya Sabha, revealed that a total amount of Rs.1.55 lakh crore was owed to banks by wilful defaulters (involving amounts of loans of Rs.25 lakh and more) against whom suits have been filed.

Put all this together, and you get a picture of a veritable orgy of looting of public money that’s being going on in the past few years – which are the Narendra Modi years.

As we all know, bad loans or NPAs (non-performing assets) have risen precipitously under Modi’s rule, partly because of the stricter accounting rules that international agreements have mandated, but mainly because of a free-wheeling loans policy. As of December 31, 2018, gross NPAs stood at Rs. 8.64 lakh crore, according to provisional data provided by Reserve Bank of India to the Ministry of Finance, quoted in its response to Rajya Sabha (Question No. 969). This is 13.6% of gross advances of Rs. 63.21 lakh crore.

But the new dimension that is emerging slowly is that under the Modi Sarkar, where the Prime Minister himself claims that he is a chowkidar (watchman) of the country’s treasury and security, a never-before-seen impunity to default on loans grew.

On the pretext of settling NPAs, banks started writing them off so that their books could be cleaned up and the amount of bad debt lowered. It is known that about 80% of bad debt with banks is owed by corporates. It is not unreasonable to assume that these write offs also favoured corporate borrowers. Technically, written off debt can still be recovered. But the banks have no interest in doing so because it is already removed from their accounting books. On an average, recoveries from written off NPAs are about 15%. In effect, Rs.5.56 lakh crore was thus handed over to corporates as gifts.

The BJP government had tom-tommed the Insolvency and Bankruptcy Code (IBC) as a big step forward to bring order in the chaotic sphere of companies going bankrupt and lenders suffering. As it has turned out, the operation of IBC has become a golden opportunity for the big fish to gobble up smaller fish – at rock bottom prices. Reportedly, out of the 1,400 cases going through the insolvency process, nearly 900 are still to be resolved. But the Economic Times report mentioned earlier points out that about Rs.1 lakh crore worth of irregularities by these bankrupt companies have come out in the resolution process. This is for companies that went bankrupt, so you can imagine what’s going on in companies that are still functional. The irregularities include unauthorised creation of assets, undervalued transactions through related entities (remember ILF&S!), circular transactions, preferential transactions with preferred group of creditors, gold plating of projects, defrauding creditors and siphoning off funds.

Then, of course, you have the 41 economic fugitives (like Nirav Modi, Vijay Mallya, Mehul Choksi, etc.) who have disappeared with close to Rs.3.34 lakh crore and are happily sitting in foreign countries. Mallya and Modi have only recently (just before elections) been caught up with in the UK and their extradition is inching along. But the money is gone.

Regarding all the other defaulters, the RBI has refused to reveal identities of non-suit filed defaulters of Rs. 1 crore and above and non-suit filed wilful defaulters of Rs. 25 lakh and above saying that this is “confidential” and RBI is exempted from disclosure under section 45E of the Reserve Bank of India Act, 1934. RBI has submitted a list of defaulters above Rs. 500 crore to the Supreme Court in a sealed cover claiming that the said information is confidential and requested that it may not be revealed to the public. The only thing RBI has revealed is the amount of wilful default – Rs.1.55 lakh crore. (On Friday, the Supreme Court asked the central bank to release the defaulters’ list and inspection reports, adding that “witholding rather than disclosing of such information would be detrimental to the economic interest of the nation.”

However, all this loot has happened under the watchful eye of the Great Watchman himself! This money could have been used to settle debt of farmers who have been committing suicide, or it could have been pumped into the rural job guarantee scheme to provide some relief to lakhs suffering from unemployment, or it could have been used to strengthen and universalise the public distribution system – or for many other works of public good. But it has all gone to create achche din(good days) for corporate bigwigs and cronies.